Some Ideas on Hard Money Lenders Atlanta You Should Know

Wiki Article

The 6-Minute Rule for Hard Money Lenders Atlanta

Table of ContentsHow Hard Money Lenders Atlanta can Save You Time, Stress, and Money.Fascination About Hard Money Lenders Atlanta5 Easy Facts About Hard Money Lenders Atlanta DescribedGetting The Hard Money Lenders Atlanta To WorkExcitement About Hard Money Lenders Atlanta

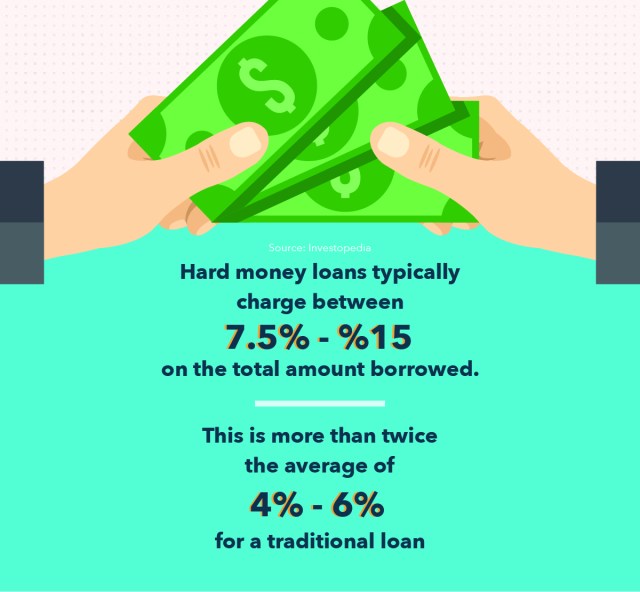

, are short-term borrowing tools that actual estate investors can use to fund a financial investment task.There are two key drawbacks to take into consideration: Tough money loans are hassle-free, yet capitalists pay a price for obtaining in this manner. The price can be up to 10 percentage factors greater than for a traditional finance. Origination costs, loan-servicing fees, as well as closing costs are additionally likely to cost capitalists more.

As a result, these fundings include much shorter settlement terms than standard home mortgage fundings. When choosing a difficult cash lending institution, it's essential to have a clear suggestion of just how quickly the home will come to be successful to make certain that you'll be able to settle the finance in a timely fashion.

Not known Incorrect Statements About Hard Money Lenders Atlanta

You might be able to tailor the settlement routine to your needs or obtain certain costs, such as the source charge, reduced or gotten rid of throughout the underwriting process. With a difficult money car loan, the home itself usually functions as security for the finance. Again, lending institutions may enable investors a little bit of flexibility right here.Difficult money financings are a good fit for wealthy investors that need to obtain financing for a financial investment property promptly, with no of the bureaucracy that goes along with bank financing. When assessing tough money loan providers, pay close attention to the fees, rate of interest, and car loan terms. If you wind up paying way too much for a difficult cash car loan or cut the settlement duration also brief, that can influence how lucrative your real estate endeavor remains in the long term.

If you're seeking to buy a house to turn or as a rental building, it can be challenging to get a typical home mortgage. If your credit report isn't where a traditional lender would like it or you need money quicker than a lending institution is able to provide it, you might be out of luck.

The Main Principles Of Hard Money Lenders Atlanta

Hard money car loans are short-term guaranteed financings that make use of the home you're buying as security. You won't find one from your financial institution: Tough money fundings are provided by alternate lending institutions such as private financiers and exclusive business, who normally neglect sub-par credit rating as well as other financial aspects and also rather base their decision on the home to be collateralized.

Hard cash loans provide a number of advantages for borrowers. These consist of: From beginning to end up, a difficult money finance might take simply a few days. Why? Difficult money loan providers often tend to put even more weight on the worth of a home utilized as security than on a debtor's funds. That's because difficult cash loan providers aren't called for to follow the very same guidelines that standard lending institutions are.

It's key to take into consideration all the hazards they subject. While tough cash car loans come with benefits, a debtor needs to also take into consideration the risks (hard money lenders atlanta). Amongst them are: Difficult cash lenders commonly bill a greater rates of interest since they're presuming even more risk than a standard loan provider would. Once more, that's because of the threat that a hard cash loan provider is taking.

The Main Principles Of Hard Money Lenders Atlanta

You definitely don't wish to lose the car loan's collateral due to the fact that you weren't able to stay up to date with the month-to-month settlements. In enhancement to shedding the possession you advance as collateral, defaulting on a tough cash loan can result in major credit rating score injury. Both of these end results will certainly leave you worse off economically than you remained in the first placeand might make it a lot harder to obtain once again.

You're not sure whether you can manage to repay the difficult money finance in a brief duration of time. You've obtained a solid credit report and should have the ability to certify for a conventional car loan that likely brings a lower interest price. Alternatives to tough money finances consist of conventional mortgages, house equity car loans, friends-and-family fundings or financing from the residential property's seller.

What Does Hard Money Lenders Atlanta Do?

No matter of what kind of lending you select, it's possibly an excellent suggestion to check your free credit rating as well as complimentary credit score record with Experian to pop over to these guys see where your finances stand.

Though it's typically feasible to obtain these kinds of car loans from exclusive lenders that don't have the exact same needs as traditional lenders, these exclusive loans can be much more expensive and much less beneficial for consumers, due to the fact that the threat is a lot greater. Traditional lenders will certainly take a complete check out your entire economic circumstance, including your income, the quantity of financial debt you owe other lending check my reference institutions, your credit report, your other assets (including cash money books) and the size of your deposit - hard money lenders atlanta.

Report this wiki page